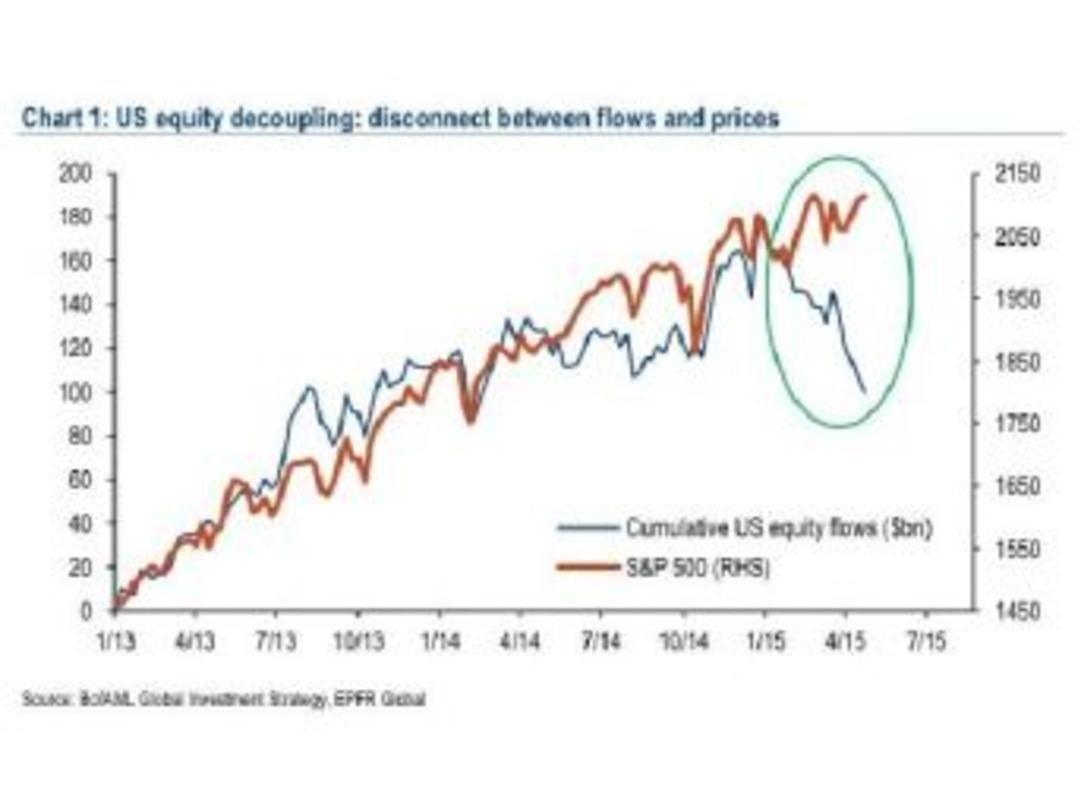

- Money has been leaving the stock markets since the begining of the year, due to weakening US economic recovery caused by strong dollar, according to the data, released by Bank of America Merrill Lynch.

In nine of the last 10 weeks, there has been a net outflow from the stock exchange, as seen on a chart released by the Bank of America Merrill Lynch, which shows that investors have pulled a net 79 billion dollars out of the stocks included in the S&P 500 Index.

"We need to see the dollar stabilize, maybe even sink down a little bit to boost earnings, giving stocks impetus to rise" Jeremy Siegel, professor of finance at the University of Pennsylvania, told CNBC. "Numerous companies have reported that the dollar's strength, it has risen to multi-year highs against a range of currencies in recent weeks, is biting into their earnings."

"But when economic data is weakening, GDP forecasts are coming down, corporate revenue isn't growing, and stocks are at record highs" analysts said, while the conditions were perfect for a "10 percent correction."

Billion-dollar investor Warren Buffett was rumored to be preparing for a crash as well, according to NewsmaxFinance. "The 'Warren Buffett Indicator' also known as the 'Total Market Cap to GDP Ratio' was breaching sell-alert status and a collapse may happen at any moment."

(GRAPH)

Anadolu Ajansı ve İHA tarafından yayınlanan yurt haberleri Mynet.com editörlerinin hiçbir müdahalesi olmadan, sözkonusu ajansların yayınladığı şekliyle mynet sayfalarında yer almaktadır. Yazım hatası, hatalı bilgi ve örtülü reklam yer alan haberlerin hukuki muhatabı, haberi servis eden ajanslardır. Haberle ilgili şikayetleriniz için bize ulaşabilirsiniz

Haber Gönder

Haber Gönder