- Turkey’s economy has been going through serious financial fluctuations since the second half of 2013 and this is continuing. Even if industrial firms tried not to lose their gross sales profits, they had to share a significant portion of it with the banking-finance sector as “interest.”

Almost everybody is accepting that industry firms have been defeated under financial pressure because of foreign exchange rate pressures and interest rates. However, there is a segment apart from sectors, and they are the households that have used home credits, auto credits, personal credits and loaned through their credit cards, the individual credit users… Consumer credits have surpassed industry, services, all sectors, one-by-one…

How much?

According to data from the Banks Association of Turkey Risk Center, loans used from the banking system have reached 1,575 billion Turkish Liras. The same source says that bad loans are 40 billion liras. This corresponds to a little below 2.5 percent of gross loans that total 1,615 billion. This is indeed not considered an alarming dimension yet.

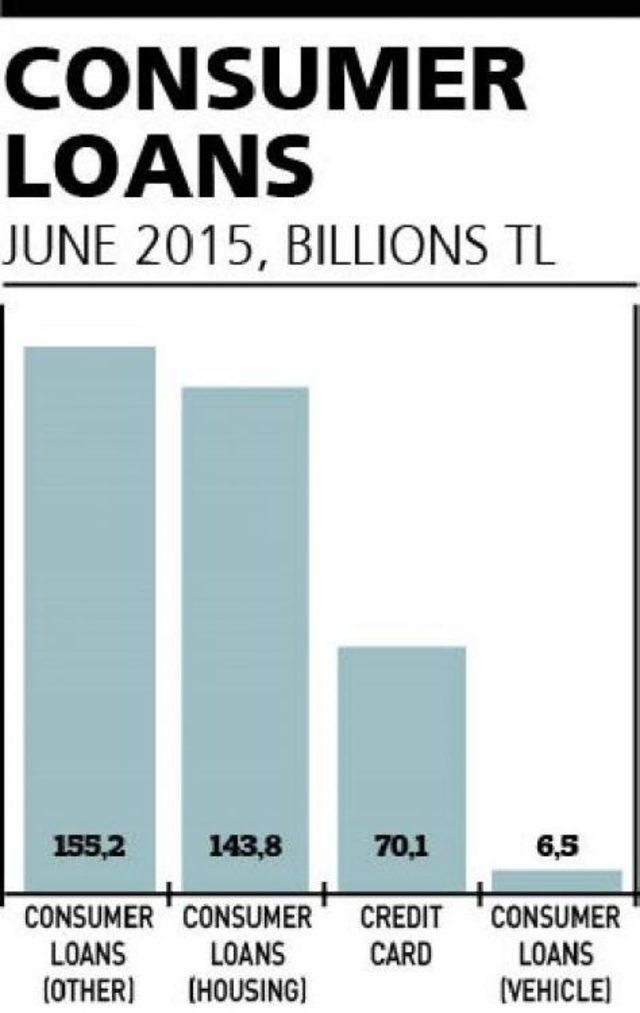

Loans that fall into the individual loan category of housing, vehicle, personal and credit cards have reached 23.9 percent with 376 billion liras. The non-performing 15 billion liras are not included in this total. In consumer loans, the rate of bad loans is nearing 4 percent and it is over the rate of general non-performing loans. Thus, we can see that the loans of households in mid-2015 reached 390 billion liras.

Today in Turkey, there is a household loaning culture unseen in the period before 2003. Consumer credits are in the form of housing, vehicle and personal loans, over credit cards and cash credits. Even though they lost their tempo in 2014, they have increased rapidly every year.

Banks, even though they slowed down a little in past years, have given one-third of their credits to individuals. However, the economic, social and political dimensions of this increase are exaggerated from time to time.

Dimensions

One of the frequent mistakes done while evaluating household loans is not adjusting the debt burden to inflation and comparing them nominally, thus exaggerating the tempo of the increase. The loan burden of households, which was 26.5 billion liras at the end of 2004, reached 390 billion liras at the end of June 2015.

This, nominally, in other words without considering the inflation, is an increase of 1,371 percent, an increase of 137 times… First of all, the inflation lump should be taken out of this. When this is done then the real loan burden, which was for example at a level of 100 in 2004, increased to a level of 600 by mid-2015.

This means that the real increase is 500 percent in 12.5 years, or 50 times. When this is cleared, then we can say the real increase is in sensational dimensions. In 2004, household consumer spending was around 400 billion liras and the burden of loan was 6 percent of it. In 2015, debts stocks are near 30 percent of private consumption. It is very clear that domestic consumption has shown a rapid increase with individual loaning. One who would have taken one unit of a loan has started taking 5 units of loans.

Loaning for what?

One of the frequent mistakes especially made in the media is that all types of household loans were a result of necessity, a type of financial difficulty; whereas the internal composition of loaning should be analyzed well and exaggeration should be avoided.

Especially after 2005 when long-term housing credits were available, housing credits in individual loans made up one-third of family loans. While auto credits had an 8 to 9 percent share in earlier years, in later years its share went down to 2 percent. Thus, when talking about household loans, we should remember that 36-37 percent of them are loans to buy houses and cars. These are not loans out of financial difficulties; these are loans made by those who have a stable income. They should be considered separately.

Financial hardships

The financial hardships of households can be seen in individual loans, in personal loans and cash loans by using credit cards. Personal loans are known to be loans which are taken to pay other loans and while their share was 22 percent of the total in 2004, today they are up to 40 percent and this is serious. Credit card loans were 18 percent of the total as of mid-2015.

It is indeed important that personal loans and credit card loans are nearing 60 percent. As of the end of June 2015, bad-performing loans given to consumers were 15 billion liras, nearing 4 percent. Problems in returns are experienced in credit cards and personal loans.

Another mistake made while talking about family loans and individual debt burdens is to look at the loaning relationship within the banking system. As a matter of fact, we know that families loan outside the banks also. Especially those segments which consider the interest rate a sin, loaning with foreign currency, purchases without using credit cards and taking loans from friends are quite widespread. Even if they constitute one-fourth of the loans which stand at 390 billion liras today then the family debt burden is immediately of much higher importance.

Debts of manufacturing industry

When individual loans are separated, then the highest debtor in sectors is the manufacturing sector. They use 24.1 percent of total loans. Excluding individual loans, the share of the manufacturing industry’s loans is 31.5 percent. Bad loans of the manufacturing industry are 9 billion liras. This is 2.3 percent of the sector’s gross loans and it is not a serious rate.

In industry, big firms are quite courageous in using credits. The biggest 500 firms listed by the Istanbul Chamber of Industry (İSO), especially in past years, take loans rapidly.

The acceptable debt equity ratio of 70 percent is a “norm” in the world. In Turkey, the ratio of firms with inadequate equity was 80 percent at the beginning of the 2000s. This rate increased rapidly and in the 2004-2007 period debts of industrial firms were about equal to 85 percent of their equities. In 2008, this went up to 117 percent. It was down to 96 percent in 2009.

In 2013 and 2014, the debts of large industry were over 132 percent of their equities.

Other sectors

After the manufacturing sector, the highest loaning sectors are commerce and construction. Excluding individual loans, the commerce sector has an 18-percent share in the total loans.

The rising star of past sectors, construction, had credit loans of 118 billion liras as of end of June 2015. As a complementary to the construction sector, the loans of real estate sector commissioners and rentals have reached 69 billion liras and when added to construction, they reach 187 billion liras. Excluding individual loans, this is 15.6 percent of the sector.

In agricultural loaning, which is the livelihood of one-fourth of the population debts are 47 billion liras and 4 percent of all-sector loans. The tourism sector (hotels and restaurants) have about the same loans as the agricultural sector.

(Graph - table)

Anadolu Ajansı ve İHA tarafından yayınlanan yurt haberleri Mynet.com editörlerinin hiçbir müdahalesi olmadan, sözkonusu ajansların yayınladığı şekliyle mynet sayfalarında yer almaktadır. Yazım hatası, hatalı bilgi ve örtülü reklam yer alan haberlerin hukuki muhatabı, haberi servis eden ajanslardır. Haberle ilgili şikayetleriniz için bize ulaşabilirsiniz